Customers in almost every industry are being given more and more choice thanks largely to advancements in technology, most notably, the integration and compatibility between systems. However, this isn’t the case for many of our banking experiences as they lag behind what we are becoming used to in many other sectors.

PSD2 and Open Banking Requirements

Let’s take a closer look at how the new open banking and PSD2 API requirements will boost choice for consumers, and standardisation across banks, benefitting fintech startups as well as the banks themselves. As consumers of digital products and services, we take choice for granted. Surfing the internet? We can choose from a range of browsers, each with its own features and flaws. Updating social media? It’s up to us which of the many networks we use to share our information. Shooting a video of a birthday party? We might use our phone’s native camera app or one of the many others we can download from an app store.

In other words, we’re free to choose the solution that best fits the task, the one we find most helpful, or the one that makes us feel most at home. We might even choose one that has a specific, unique feature.

So why doesn’t the same apply to the way we interact with our banks?

Late developers

Banks are traditionally large, cumbersome organisations where, when innovation happens, it stays in a closed loop within the parent company. Partly due to compliance, partly due to regulation and to some extent the need to keep ahead of the competition, banks keep their cards close to their chests.

They certainly don’t like to share customer information with each other or with other industries, but steps are being taken to change this. As we’ve seen with tokenization and contactless payments, new technologies eventually become ubiquitous across the industry.

However, banks are forced to adopt these innovations to keep up with the pack. How they will respond to technology as a way to simply share customer information or payment methods remains to be seen.

Taking the rough with the smooth

We’re used to interacting with our banks online, whether it’s via a desktop browser, mobile site or bespoke mobile app, giving us the impression of choice. But all these interactions are delivered by the bank’s own team, meaning our choices are more limited than they might first appear.

What if these online services don’t provide our account information in the right way, or if we don’t like the features provided? A few years ago my wife struggled with a personal banking website which suffered from a poor UI and slow loading speeds, often hanging mid-transaction. Clearly, the bank wasn’t investing enough in their online property, but we enjoyed the ethical financial products and good interest rates they provided us. As consumers, we couldn’t separate the good from the bad: if we wanted the advantages, we were stuck with the disadvantages.

What if we could have chosen the bank for the values we like, but used another service to interact with our bank accounts, mortgage and savings in a way that we preferred? Wouldn’t that be a better experience?

Opening up the industry

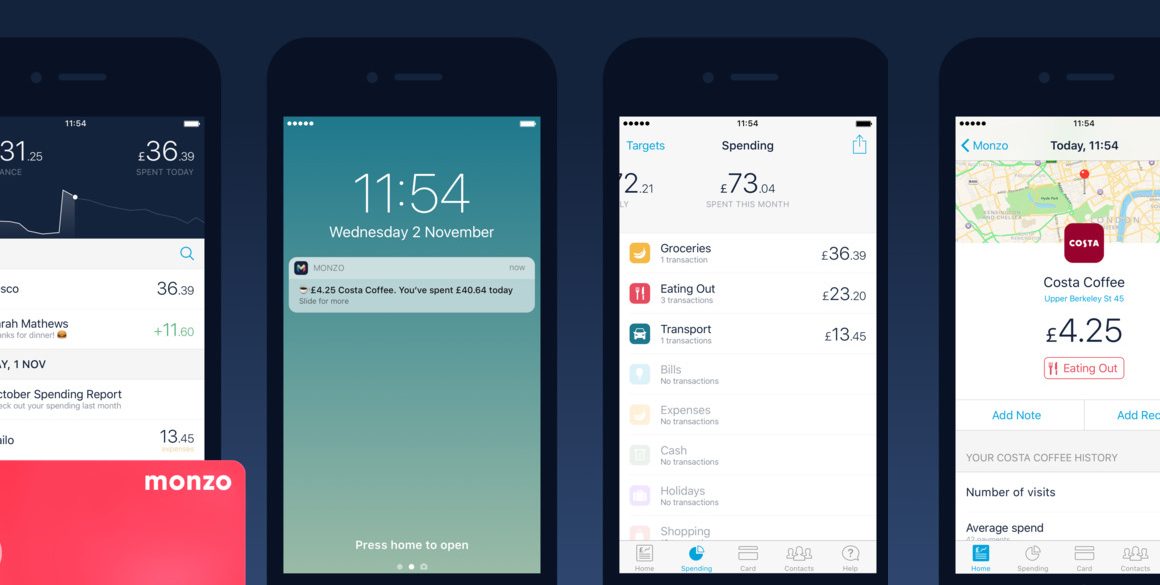

In recent years, various governments and organisations have been pushing banks to accept third-party services integrating with their systems in a standardised way. This would require banks to provide a set of APIs (Application Programming Interfaces) to give structure and consistency to the way account information and other products are fetched and manipulated by the third party system. As a result, external companies would start making well-built apps and online services that use these APIs to interact with any given bank.

For consumers, this would mean the ability to keep the beneficial parts of a particular bank but sidestep the bad by using the third-party banking app they preferred. Not only could this app offer features traditionally provided by the bank, but also new ones, such as showing mortgage rates from competing banks, or projections based on markets and rival bank data.

Savings for all

The banks themselves might be reluctant to adopt these measures, not seeing a financial benefit to opening up their systems to third parties. However, they could very well reap benefits.

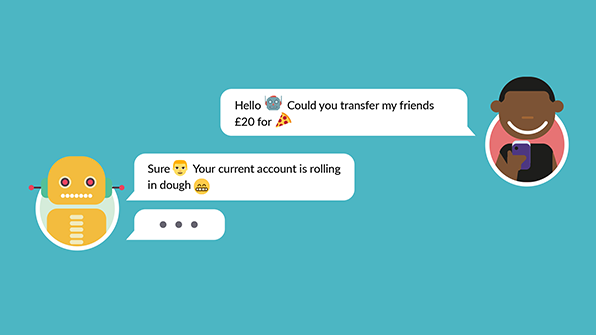

As well as dashboard-style information for customers via third-party apps and websites, the ability to allow third parties to process payments will be a game-changer.

Currently, making a payment on a website such as Amazon leads to a series of intermediary steps, each with their own charges. If the customer could authorise Amazon to connect and accept payment directly to their bank account, the process would be both simpler and cheaper.

The revolution is coming

This is an exciting time for banking, which will usher in a new wave of Fintech start-ups. These companies will offer us insights into our financial data, helping us choose better banking products. Open banking also promises to change the way we pay for goods and services online, and maybe even how we get paid.

Key to all of this, of course, is consumer trust: methods of authorising third parties to access our money will have to be bulletproof. But opening up banking to third-party services is just the start — many other industries including energy, telecoms, logistics, and health could benefit from open APIs, helping customers to choose how they interact with these services.

How do you think banking will be shaped by the new open API’s? Let us know your thoughts.